Best Password Manager for Insurance Providers

In the insurance industry, handling sensitive data with care is not just a recommendation—it's an absolute necessity. With the increasing frequency of cyberattacks and breaches, the Principle of Least Privilege (PoLP) becomes more important than ever. PoLP dictates that individuals should only have access to the specific data necessary to perform their job functions. When you organize your passwords based on this principle, you limit access to your most critical information, minimizing potential damage in the event of a breach.

A security breach can be catastrophic for an insurance provider. Trust and credibility are essential in this industry, and a single breach can cause irreparable damage to your reputation. The costs associated with recovering from a breach—whether financial, legal, or in terms of customer trust—can be overwhelming. But there’s good news: implementing PoLP, along with a robust password management system, can significantly reduce your risk.

Table of Contents

What requirements are there for an insurance provider password manager?

When choosing a password manager for an insurance company, certain requirements must be met to ensure compliance, security, and functionality. While specific needs may vary depending on the size and scope of the provider, three key factors consistently stand out: security, scalability, and ease of use.

Security

Encryption

Insurance providers are prime targets for hackers due to the wealth of sensitive information they store, from personal identification numbers to financial records. Therefore, the security of any password manager is paramount. At the core of this security should be strong encryption—ideally AES-256, the gold standard for protecting data. With encryption, even if a hacker manages to gain access to the password manager, the stored credentials will remain indecipherable without the encryption key.

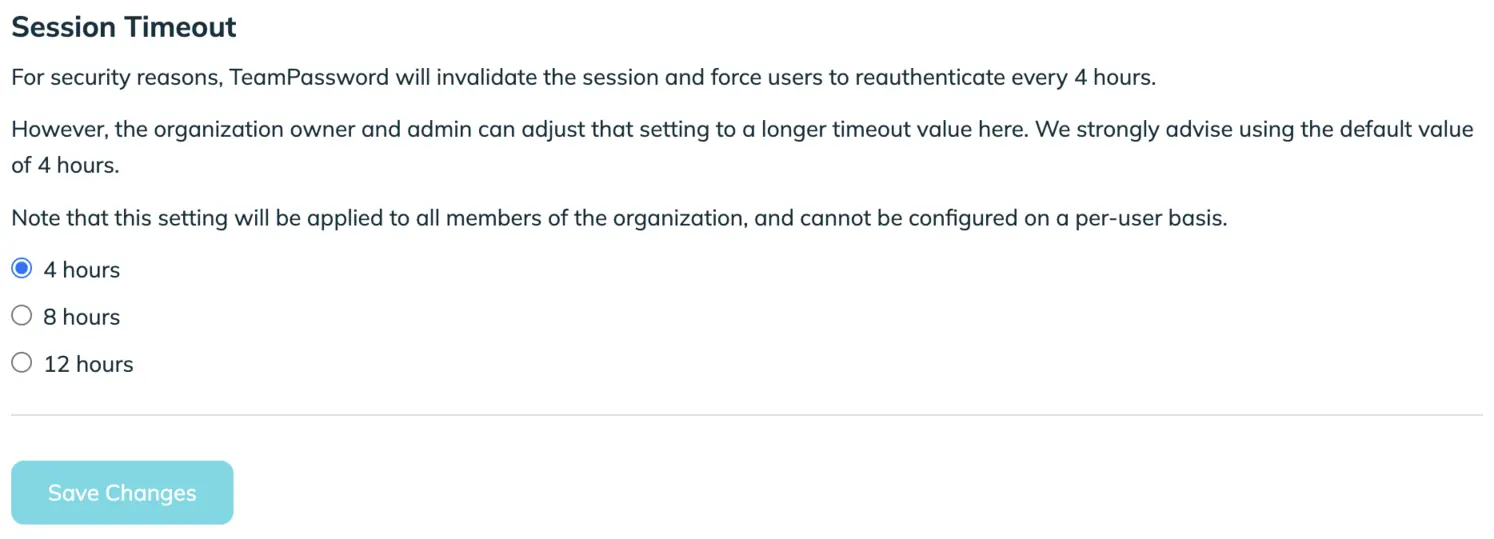

Automatic Logoff

You should be able to set the time after which your employees will be logged out of the password manager and re-authenticate. This way, employees will need to sign in throughout the day - or only once - depending on your security requirements.

Enforceable 2-factor Authentication

Beyond encryption, enforceable two-factor authentication (2FA) is another non-negotiable feature for an insurance provider’s password manager. 2FA adds an extra layer of security by requiring a second form of authentication (such as a mobile device) in addition to a password. This helps ensure that even if passwords are compromised, unauthorized access is blocked. Insurance companies can further enhance security by integrating TOTP (Time-based One-Time Password) into their 2FA process, which generates a temporary, unique code, making it more resistant to phishing attacks.

Role-based Access

Another critical aspect of security is the ability to set different permission levels for users (often called Role-based Access, or RBAC). Insurance providers often have various departments, each with different needs for accessing data. By assigning different levels of access, employees are restricted to only the data they need to perform their job. This implementation of PoLP ensures that sensitive information is better safeguarded.

Ease of Use

While robust security is essential, it's equally important that a password manager is user-friendly. In the fast-paced world of insurance, employees need tools that work efficiently without bogging them down with unnecessary complexity. A password manager should have a clean, intuitive interface that anyone in the company can use, regardless of their technical expertise.

Mobile apps and browser extensions are key features that contribute to ease of use. Employees working remotely or in the field need quick, secure access to their credentials. A password manager with a well-designed mobile app allows for this flexibility, providing the same level of security and functionality as the desktop version. Browser extensions streamline the login process by automatically filling in passwords, reducing the chance of human error and saving time.

The user experience should be seamless, allowing employees to store, retrieve, and update passwords quickly. By making the process straightforward, the password manager reduces friction and encourages widespread adoption across the company. This ease of use ensures that the security benefits of the password manager are realized without creating bottlenecks.

Safe Credential Sharing

Credential sharing is often necessary in insurance companies, where multiple employees may need access to shared accounts or tools. However, sharing passwords via insecure methods, such as email or messaging apps, can easily lead to security breaches. A password manager must offer a secure method for sharing credentials among team members, without compromising security.

A good password manager will allow for encrypted sharing of passwords. The recipient should only be able to view the password if they have the correct permissions, and the password itself should never be exposed in plain text. Some password managers also allow for temporary access, where passwords can be shared for a set period, after which they automatically expire. This feature is especially useful for insurance agencies with contractors or part-time employees who need limited-time access to certain accounts.

The ability to monitor and audit shared passwords is also a valuable feature. Managers can track who has access to what credentials, when they were shared, and whether any changes were made. This transparency helps maintain accountability and ensures that security is always a top priority.

Cross-Platform Functionality – Remote Work Compatible

The modern insurance industry often involves remote work, whether due to field visits, work-from-home policies, or collaborations with global teams. For this reason, a password manager that works across platforms is essential. It should seamlessly integrate with browsers on Windows, macOS, and include apps for iOS and Android devices to accommodate a diverse workforce using various tools and systems.

Cross-platform compatibility ensures that no matter where an employee is working from, they have access to the same level of security and functionality as they would in the office. The ability to synchronize passwords across devices in real time is another crucial feature, as it allows employees to access updated credentials instantly, without the risk of version discrepancies.

In an industry where data security is critical and remote work is becoming more prevalent, choosing a password manager that supports a distributed workforce is no longer optional—it's essential. Password managers that offer cloud-based access with offline functionality ensure that employees can securely access their credentials regardless of their internet connection.

TeamPassword

TeamPassword offers a user-friendly and efficient password management solution that’s perfectly suited for insurance agencies. With its intuitive interface, TeamPassword simplifies password storage, organization, and access. Even the least tech-savvy team member will find the platform easy to navigate, making it ideal for diverse teams in the insurance sector.

Implementing TeamPassword is a breeze. Insurance agencies with limited IT resources can set up the system within minutes, enabling them to start managing passwords securely without requiring dedicated technical personnel. This simple onboarding process ensures minimal disruption to day-to-day operations, which is particularly important for fast-paced insurance environments.

Cybersecurity is a top concern for insurance agencies, and TeamPassword places it at the forefront. The platform uses industry-standard AES 256-bit encryption to protect sensitive client information and internal systems, ensuring that passwords are stored securely. TeamPassword protects against unauthorized access, making it an essential tool for maintaining confidentiality and safeguarding against data breaches.

Collaboration is also key in the insurance world, where teams need to work together seamlessly. TeamPassword allows for the creation of unlimited and customizable groups, making it easy to categorize and selectively share passwords. This is particularly useful in large insurance firms with various departments or teams that need access to specific tools or platforms. In situations where employees leave or roles change, administrators can quickly revoke access to ensure former employees no longer have access to critical accounts.

TeamPassword's customer support is another standout feature. While the platform is designed to be straightforward and reliable, dedicated customer service is available Monday to Friday, ensuring that if issues do arise, insurance providers can get prompt, real-time assistance. Whether it's a quick troubleshooting session or advice on optimizing security settings, TeamPassword’s support team is there to help.

Affordability is also a key selling point. TeamPassword offers competitive pricing, starting at $2.40 per user per month for an annual subscription. For larger insurance firms or those with more complex needs, TeamPassword offers an enterprise plan with additional features.

LastPass

LastPass has been a dominant player in the password management space for years, though its reputation has been tarnished by a series of security breaches. For insurance providers, this could be a cause for concern. However, despite these setbacks, LastPass remains a feature-rich option that offers solid functionality for managing passwords at scale.

One of the most useful features for insurance providers is LastPass’s security dashboard. This dashboard highlights weak or reused passwords, helping agencies stay on top of potential vulnerabilities within their systems. The platform also provides emergency access, enabling designated individuals to access accounts in case of an emergency—a crucial feature in high-stakes industries like insurance where continuity is key.

While LastPass may be less intuitive than some of its competitors, it offers essential collaboration tools. Passwords can be shared through email or via shared folders, allowing team members to access accounts without having to send passwords over unsecured channels. Additionally, passwords can be securely shared only with those who have a LastPass account within the organization, adding an extra layer of security when handling staff changes.

Pricing for LastPass starts at $4 per user per month for teams, with a free version available for individuals. However, insurance firms may need to pay additional fees for certain integrations and advanced features, making it a slightly more expensive option than some of its competitors.

1Password

1Password is well-known for its emphasis on security, making it a top choice for insurance providers dealing with highly sensitive data. With end-to-end encryption and zero-knowledge architecture, only authorized users can access stored credentials, reducing the risk of external breaches.

One of the unique aspects of 1Password is its ability to create vaults for different teams or departments, allowing for better organization of credentials. For insurance firms with multiple branches or specialized departments, this level of organization can streamline access control, ensuring that only those who need certain passwords can retrieve them.

1Password also integrates with a wide variety of platforms and offers advanced MFA options such as biometric login, which enhances security without complicating the user experience. It’s a great solution for agencies that want to prioritize both security and user convenience.

Bitwarden

Bitwarden is an open-source password manager that has gained popularity for its flexibility, transparency, and strong security protocols. For insurance providers, Bitwarden offers self-hosting capabilities, which can be especially appealing for firms that prefer to maintain full control over their password management infrastructure.

Security features like AES-256 encryption and PBKDF2 hashing ensure that sensitive data remains protected. For insurance agencies handling vast amounts of customer information, Bitwarden’s ability to perform security audits helps ensure compliance with regulatory requirements.

Bitwarden is also known for its affordable pricing structure, with a free version for individuals and low-cost team plans starting at $3 per user per month. It offers a compelling balance between cost and features, making it a practical option for smaller insurance firms or those operating on a tighter budget.

Dashlane

Dashlane is another strong contender for insurance providers, offering top-tier security features alongside an easy-to-use interface. With Dashlane, passwords are encrypted using AES-256 encryption, and features like dark web monitoring alert users if their credentials have been compromised.

The platform also integrates well with multiple devices and browsers, allowing employees in insurance firms to access passwords whether they’re working in the office or remotely. Dashlane’s Password Health tool is particularly useful for insurance providers, as it scans for weak or compromised passwords and suggests improvements to bolster security.

Dashlane’s pricing starts at $5 per user per month for teams, with advanced business plans available that offer additional functionality, including VPN services for added security during remote work.

TeamPassword is the Best Password Manager for Insurance Providers

When evaluating all the options, TeamPassword stands out as the best password manager for insurance providers. Its combination of user-friendly design, robust security features, and affordability make it an excellent choice for agencies of all sizes. Here’s why:

| Feature | TeamPassword |

|---|---|

| Ease of Use | Simple interface, minimal onboarding time, no IT expertise required. |

| Security | AES-256 encryption, enforceable multi-factor authentication, permission levels. |

| Collaboration | Customizable groups, encrypted password sharing, easy access management. |

| Cross-Platform Functionality | Seamless integration across desktop, mobile apps, and browser extensions. |

| Affordability | Starting at $2.40 per user per month, making it a budget-friendly solution. |

| Customer Support | Prompt, real-time support available Monday to Friday with a fast response time. |

In conclusion, TeamPassword combines the best features that insurance providers need—security, scalability, and ease of use—all at an affordable price point, making it the top choice for password management in the insurance industry.